My family have been pawnbrokers for a very long time. In fact we have been in the trade for nearly 180 years. The original business began in 1840 and although that business has since changed ownership 3 times since we sold it in 2007, I am proud that my business, established in 2011 still continues the family tradition. While chatting to my father recently we started talking about some of the unusual items we get asked to lend on these days.

A good customer of our Toxteth store wanted to know if we could lend him £200 against his state of the art carbon bicycle worth over £1000 and his I-Pad. Another man came in asking if we were interested in lending on the electric piano he uses at his local prayer group so they could make repairs to the heating system and the day was complete when a third customer asked if we could lend on his vintage wine collection so he could pay his tax return!

Well?…… Why not?……..at the end of the day a pawnbroking loan is just a secured loan and as long as the item we lend against is genuine and is worth more than the value of the loan in-case we have to sell it to recoup the money that’s owed, we can consider a loan against it. The key part is ensuring the customer has total provenance and complete ownership of the goods they wish to pawn and establishing a value on which to base the loan.

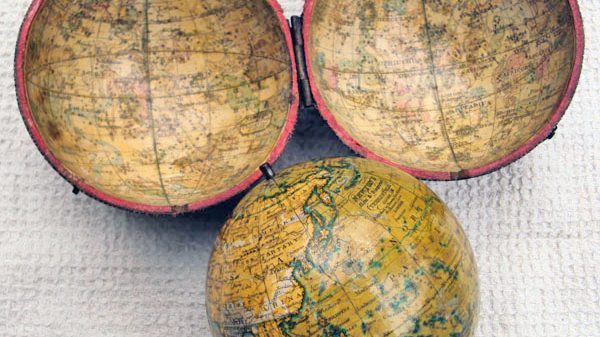

So, I was telling my father these stories and he said they were once asked to lend on a budgie in a cage, a penny farthing bicycle and a horse and trap! He suggested I had a look in some of the old loan books passed on to me from my grandfather.

They made interesting reading!

Monday 15th August 1938

Value lent 2 pounds 4 shillings and 3 pence (£3-4s-3d) Converted to today’s money and with inflation that’s £293.82.

Items Pawned throughout the day: 2 overalls, socks, stair carpet, khaki shirt, 2 blankets a cap and some pit pants and a petticoat!

There was little to no gold involved because few people owned any.

The greatest possession people owned were their Sunday ‘best’ clothes and it was only in the late 20th Century that gold and silver became widely owned by the working man. In 1836 it is recorded that 41% of loans were against women’s gowns and petticoats and only 3% against gold and silver rings.

Today 95% of our loans are on gold jewellery, diamonds and luxury watches such as ROLEX. However we do also lend on electrical items such as smart phones, lap tops and game stations and will consider most things of value.

We will certainly draw the line on knickers and petticoats, but branded handbags, carbon bikes and I-Phones can be just as valuable as a gold chain or a diamond ring, so if these are the greatest possessions of the new generation then the modern pawnbroker should move with the times. When you think about it, perhaps things just haven’t really moved on!

I will keep the old books on display in our 3 Yorkshire stores for this month at Batley, Seacroft and Shipley so you are welcome to come and have a browse through them.

If you are an old customer of the earlier generations, pop in and make yourself known – I would love to hear your story and see if we can share it in next months diaries or on our new website www.browndandgold.co.uk

Chris Brown